Aerodrome (AERO): Redefining Liquidity Infrastructure on Base

What Is Aerodrome?

(Source: AerodromeFi)

As the DeFi sector continues to advance, robust liquidity infrastructure has become even more essential. Aerodrome serves as the core liquidity hub on the Base network. It is an automated market maker (AMM) and an ecosystem that features low fees, strong incentives, and decentralized governance.

Why Choose Aerodrome?

Aerodrome offers several distinct advantages over traditional DEXs:

- Community-Centric Model: The platform returns all fees and rewards directly to users.

- Transparent Governance: Holders of $veAERO can vote on fee distribution, token emission rates, and the use of funds.

- No VC or Pre-sale Tokens: Built as a true public good.

- Low Slippage Trading: By leveraging Base’s high performance and Flashblocks technology, Aerodrome offers fast, cost-effective trades with minimal slippage.

Token Model: $AERO and $veAERO

Aerodrome employs a dual-token structure:

- $AERO (Utility Token): The main reward for providing liquidity.

- $veAERO (Governance Token): Created by locking up $AERO and used for voting and governance. The lock-up period can be up to 4 years. The longer the lock, the greater the voting weight.

This framework ensures that the tokens serve both as incentives and for governance, promoting the platform’s long-term stability and growth.

Core Mechanisms and Reward Distribution

Aerodrome structures token issuance and rewards using a dynamic, weekly-based system:

- Epoch System: $AERO emissions are automatically adjusted each cycle according to preset rules. Participants share rewards proportionally based on liquidity pool weights.

- Aero Fed: When emission rates drop below a certain threshold, the community votes to decide whether inflation should be adjusted.

- Rebase Model: Designed to reward long-term lockers, prevent rapid dilution of voting power, and maintain ecosystem stability.

Together, these mechanisms ensure that $AERO is not just a tradeable asset; it acts as a driving force behind continuous protocol evolution.

Future Roadmap

Aerodrome’s development roadmap consists of three phases: early, growth, and maturity.

- Early Phase: Focus on promoting partnerships, community airdrops, and participation incentives.

- Growth Phase: Roll out all platform features, strengthen DAO governance, and expand into international markets.

- Maturity Phase: Establish itself as the primary liquidity hub on Base, integrating AI, data analytics, and other innovative technologies for continuous improvements to user experience.

This roadmap not only highlights planned technical advancements but also underscores Aerodrome’s vision of building foundational infrastructure for decentralized finance.

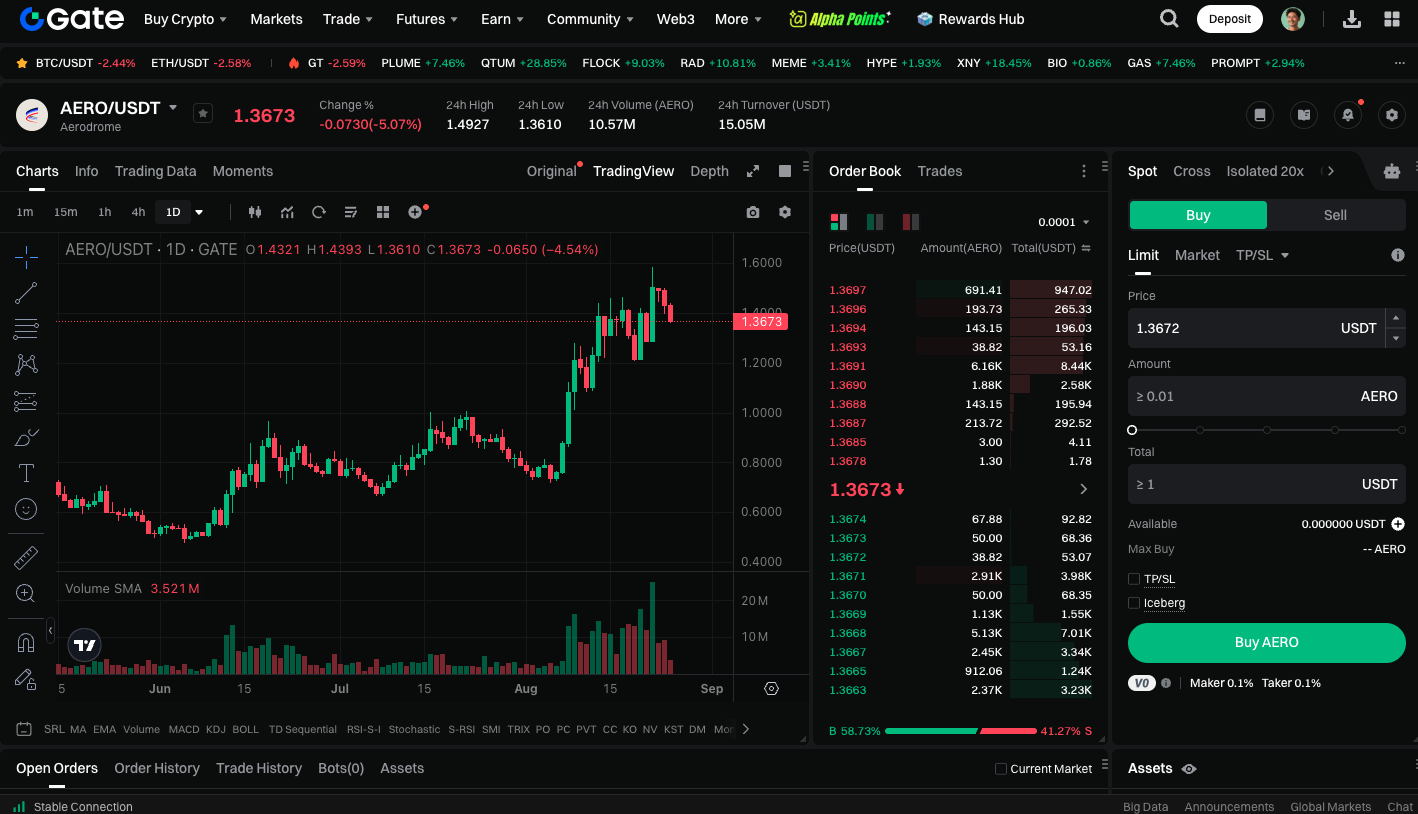

AERO_USDT Spot Trading

You can buy and sell AERO tokens easily through the AERO/USDT pair. Participants in the AERO/USDT liquidity pool earn trading fees and receive additional $AERO tokens from the platform.

Start trading AERO spot now: https://www.gate.com/trade/AERO_USDT

Summary

Aerodrome Finance is a community-driven DEX focused on governance. The platform is designed to build liquidity infrastructure as a public good and discourages short-term speculation. Through its dual-token model ($AERO and $veAERO), Aerodrome enables participants to earn rewards and participate in governance. For both the Base network and the broader DeFi landscape, Aerodrome represents a milestone, providing efficient and transparent liquidity solutions.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025